November 2024 Market Snapshot

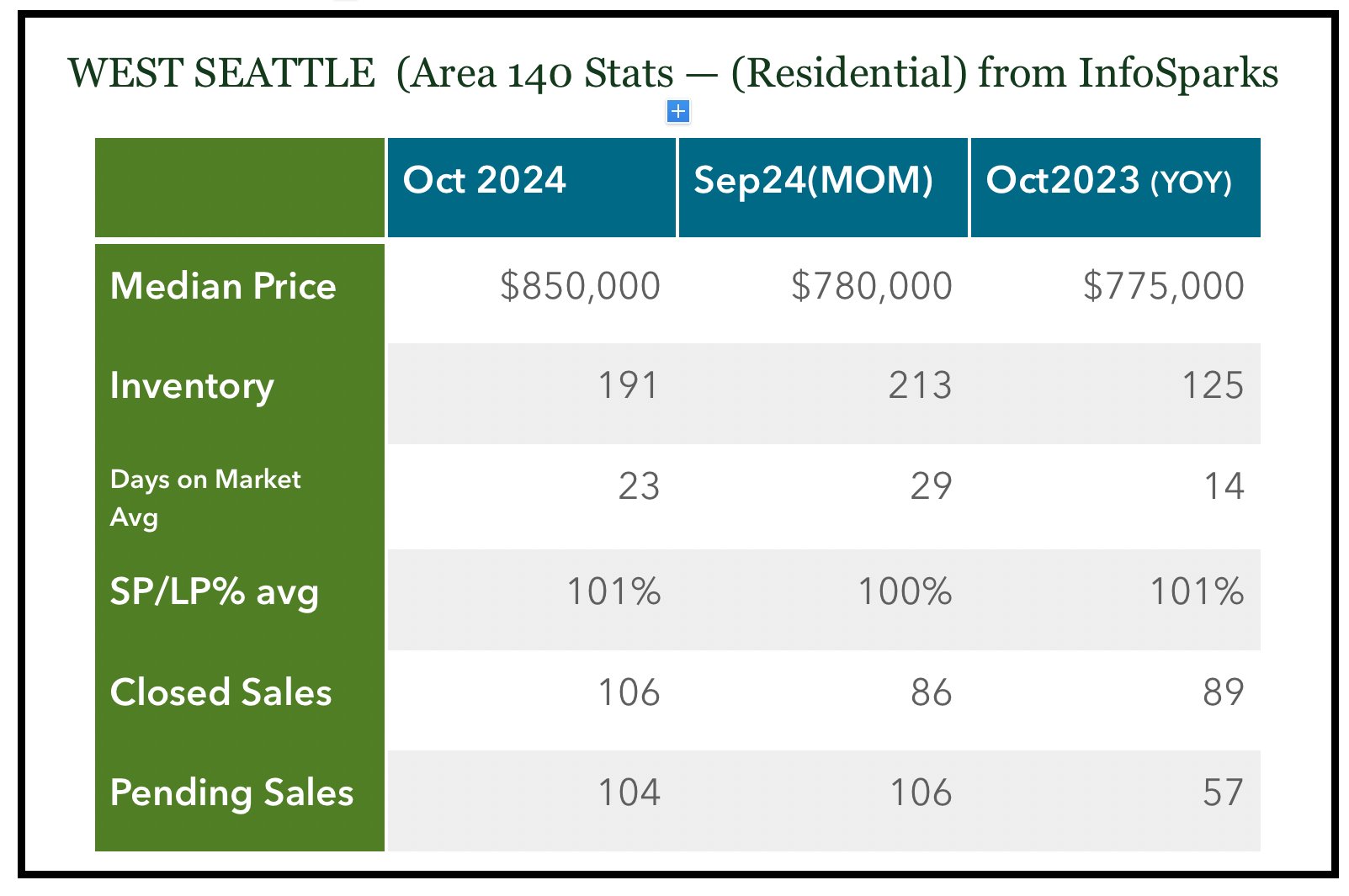

October numbers are in and paint the picture for a pretty active fall market. October pricing jumped back up as September pending sales closed. Sellers took advantage of the wonderful weather and got over 100 homes under contract! Almost double the amount from a year ago. It was a less competitive market (with only about 25% of sales receiving escalated offers) but still brisk in terms of overall numbers (pending, closed and median price).

Inventory numbers are still higher than at any point over the past several years. Houses are sitting on the market longer but 47 of the 106 sold homes were under contract in a week or less. Homes that completed pre-list updates and priced accordingly are still seeing good results. This recent West Seattle Realty listing came out on Thursday and was Pending by Monday.

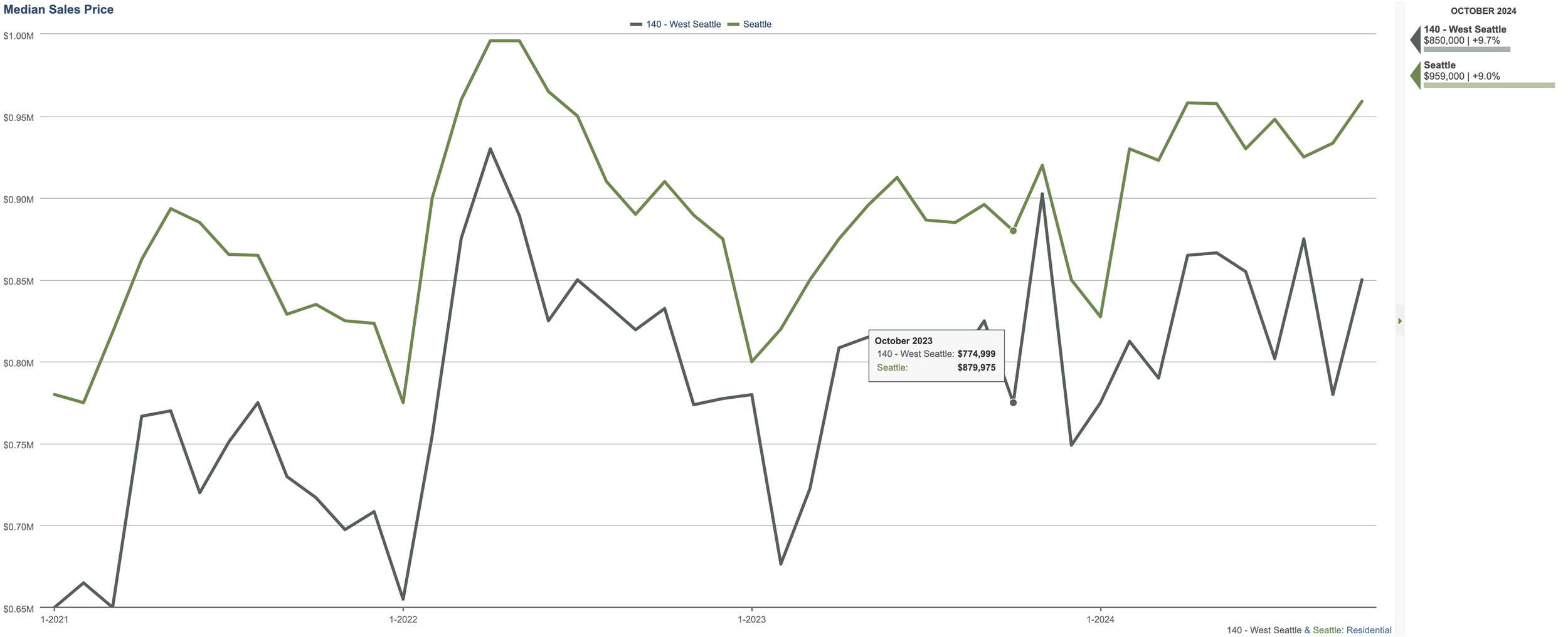

The wild pricing swings are more reflective of higher homes closing in a particular month. 19 of the 106 sold homes in October had sold prices of 1.25M and more. Overall, pricing has been fairly steady (but elevated) this past year. The West Seattle market has essentially followed the overall Seattle metro trends.

West Seattle Closed Sales (109). were up significantly last month. This was a result of homes (under contract in August and September) finally closing. It can take 3-4 weeks for properties to close once under contract (and average 23 days before receiving an offer). note: Seattle metro saw a huge increase. This is likely properties that went under contract in September closing in October. You can see in the pending graph a highly elevated number.

Typically, prices start to flatten out towards the second half of the year. October Median Price was not far off the peak of 2024. Pricing remains high (as well as sales). All this despite higher interest rates since the rate cut.

It would take 2.2 months for all homes to be sold (if no new listings came on). 4-6 months is considered a balanced market. The number indicate a sellers market. But, sellers have started to see homes sit longer, reduce list price and provide more concessions than in the recent past. And, Buyers have benefitted from less multiple offer situations, concessions and lower interest rates (compared to 7%+ in the spring).

The Seattle Metro market remains strong. October say gains in Median Price (959k), closed sales (640) and strong pending contracts (600). Higher interest rates and election uncertainty did little to deter the real estate market. Typically, the market slows down as we head into winter and then starts to ramp up again in February-March.

One last chart to share.

West Seattle is a big area and has over 100,000 residents. You can’t paint the entire area with a single brush. Area code 98116, which serves the Junction to Admiral and down to Alki, is a typically sought after area for buyers. While we do tend to see higher price points in this area, key metrics actually show a decrease in pricing from 2023 and since the beginning of the year. As agents, we typically feel prices having been going up for residential homes in this area. So, why is the pricing going down? A likely cause is the sale of more townhome, ADU/DADU condos (3 homes per lot) sales. We are seeing more closed sales and these products have lower price points, thus influencing Median Price. It appears the cities attempts for Middle Housing is providing more sales, at lower price points, in more central areas. Residential homes, on 4000-5000 sf lots, are getting a higher premium but there are less of them being sold. It will be interesting to watch this play out, as the city is hoping to introducing even more higher density for the California corridor.