December 2024 Market Update

November is in the books and we started to see some signs of the typical seasonal market slowdown. Overall, we saw a decline in pricing and closed sales in West Seattle. There were indications the market isn’t ready for hibernation as Buyers stayed fairly active. Pending numbers stayed fairly steady, despite the overall high pricing and interest rates. Rates actually went up (upper 6-low 7s) after the early November Fed Rate Cut as experts expect stronger economic growth and higher inflation in the near future. Interest rate projections have shifted and we should expect rates in the 6’s (not in the 5’s) for the foreseeable future. 6 is better than 7 as higher interest rates have kept inventory numbers low (sellers not wanting to trade sub 4% for +7% and staying in their “forever’ home”) and lower inventory numbers have kept prices high. For now, buyers have seemingly adjusted to the new normal or adjusted their offer price, as we saw more properties sell for less than list price in November.

numbers based on residential home sales (no condo except for condo res/adu/dadu where inputted)

Pricing has bounced around quite a bit the past couple months. The number is typically more indicative of previous months activity (November closes are generally homes that went under contract in October). November 2024 pricing mimicked the previous recent up and down monthly trends. Of interest, you can see a highly elevated November 2023 Median Price of 902k. This is likely highly weighted from higher price point sales in October (maybe September) 2023. There were also less closed and pending sales in 2023 which also influenced. Historically, we see pricing drop in November and December, as there are less transactions and new inventory, and then pick back up late winter/early spring. We’ll keep watch the next couple of months but so far pretty steady the past couple of months. Look at our recent blog post to plan and set realistic expectations for next year.

Inventory numbers dropped from the previous month. Some of this can be attributed to homes going under contract but lack of new listings and canceled listings were bigger influencers.

New listings (coming on the market) dropped as only 56 new listings (vs. almost 200 in October) came to market last month. Also, some listings either were canceled or taken off market. About 27 properties either Canceled, Expired or went Temporarily Off Market in November. We might expect to see some of those come back on the market at some point or sellers have had to change plans and stay put.

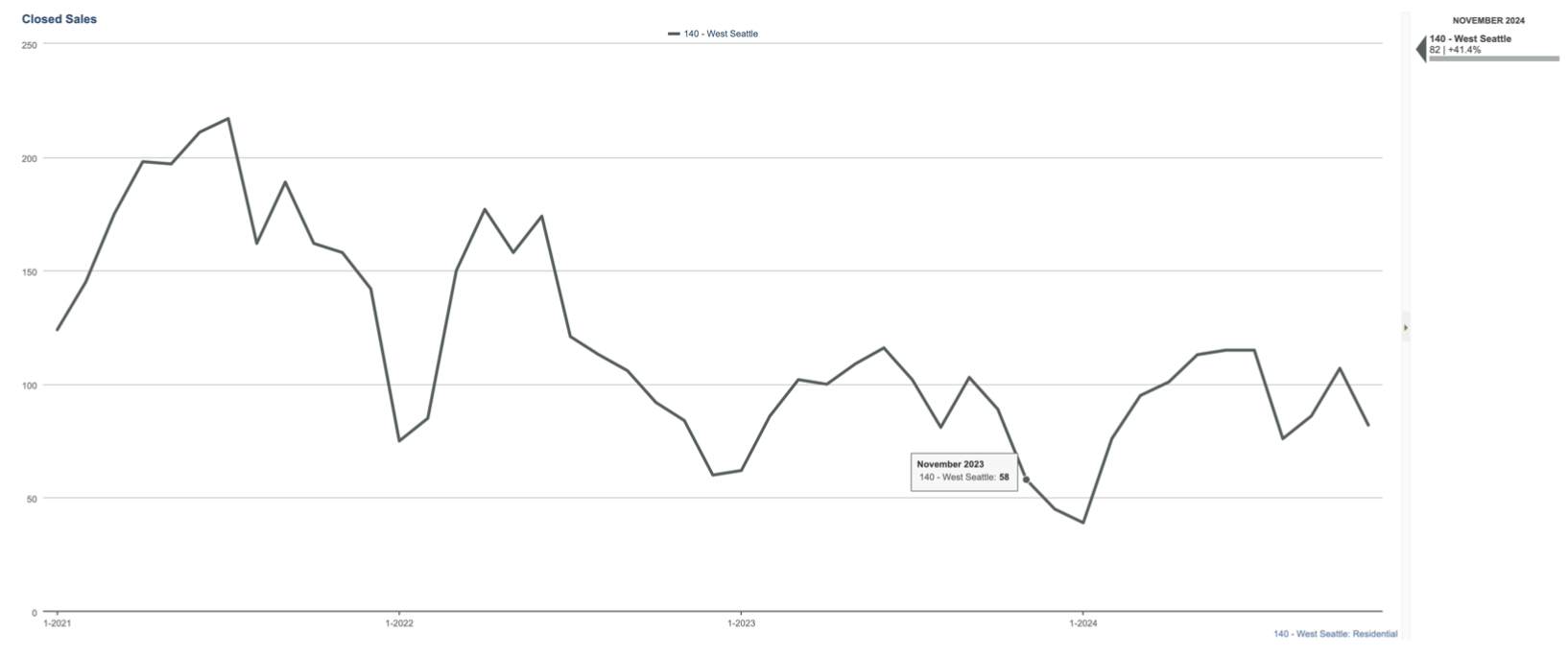

Closed sales were trending down as they typically do this time of year. We saw 82 closed transactions in November. 16 homes sold for over ask, 28 for list price , and over 50% of closed sales sold for under list. Market realities (longer days on market, less buyer urgency) finally settled into the market place for some. Furthermore, 23 of the closed sales had done a price drop before receiving an offer. That’s almost 30% of all sales. A lot different from the spring market. In April of 2024 there were 139 closed sales. 19 sold for less than list, 69 for over list (and the rest right around list)! Different season, different market.

Of note, there were 92 Pending properties that will presumably close before the end of the year.

It’s also pretty remarkable to see the overall drop in sales from just a couple of years ago. Interest rates were much lower then and we saw near double the transactions.

We have one more month to go, but overall 2024 looks much like 2023. Rates have stayed higher than recent history but around the same as before 2010. Prices have stayed strong with higher demand and lower inventory.

Seattle Metro market mostly followed the same activity trends. Inventory and sales numbers were down and pending numbers steady. Pricing wasn’t that much off from the previous month October. October was peak 2024 median at 960k and the second busiest month of closed sales at 631. October (or rather September) was a busy month. November, while not as busy as the month before, definitely was more active than a year ago. Buyers still need housing despite higher prices and interest rates.

Closed sales Seattle Metro

Higher prices and higher interest rates have just become market realities. Rates have drifted up since we saw low 6’s in September to right around 7% at the end of last month. They have started to drop this past week and are closer to 6.5%. No one is certain of what to expect in 2025 but let’s hope lower rates are in store. That could possibly free up inventory and make mortgages less expensive.

You can see below that different markets have had elevated rates before (even higher).

So, what does this mean for you and what will 2025 look like? Reach out and we’d be happy to discuss…