2024 Year End Recap

2024 is at an end! How did it stack up to recent years? Based on the analysis of the West Seattle real estate market for 2024, here are the key points:

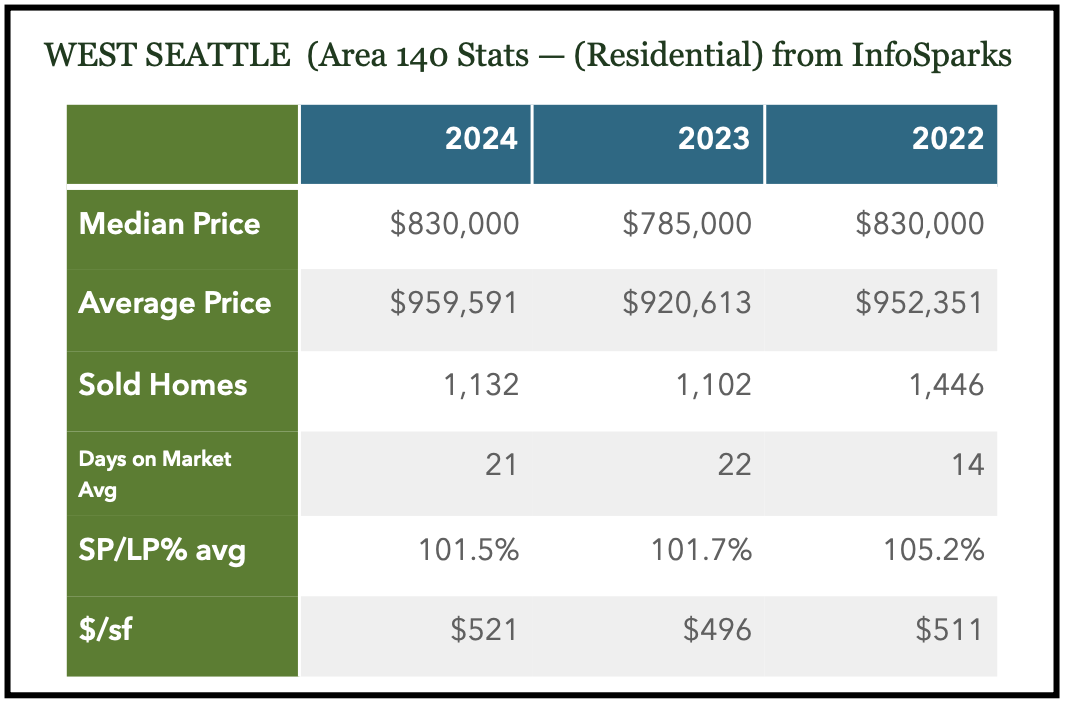

Pricing Trends: Despite the higher interest rates compared to pre-2022 levels, home prices in West Seattle have remained fairly consistent. The market mirrored trends seen in the broader Seattle Metro area, with pricing stability noted, although sold homes have decreased from previous years.

Inventory Levels: Higher interest rates contributed to lower inventory levels, with nearly 60% of homeowners having interest rates below 4%. This phenomenon keeps inventory low and prices relatively high.

Sales and Transactions: Closed sales for 2024 have mirrored those of 2023 but are significantly down from 2022.

A look at the statistics show Seattle Metro and West Seattle pretty much mirrored each other in trends. Pricing stayed consistent and sold homes are down from two years ago. The average price is higher as it pulls from higher end homes throughout the city. Houses did tend to sit on market a little longer as a whole. But that could be more a sign of townhome/ADU/DADU staying on market longer. We feel that primary residential homes (well conditioned and priced) sold quicker, typically less than 7 days.

Median Prices: The median pricing, provides a more stable gauge of home values than average price, is higher the past several years despite higher interest rates . For instance, the 2021 median home price in West Seattle was around $750,000, when interest rates averaged 2.96%. The median for 2024 is around $830,000 when rates hovered in the upper 6’s-low 7’s. The average monthly payments have notably increased due to rising interest rates.

2024 Closed Sales are similar to 2023 but considerably down from 2022. And consider that in 2021, West Seattle had 2,151 closed residential transactions! That’s almost twice as much as 2024’s 1,079. As mentioned above, interest rates were near 3% in 2021.

Now a quick look at Condominiums.

West Seattle saw a substantial increase in Condo Median price, +16% over 2023. A couple of reasons can be attributed. There are typically less condo transactions, so higher priced closings will influence. Also, the advent of the condo-ization of properties (3 homes per lot, designated as condos vs. zero lot line) have pushed what we would have considered some stand alone homes/townhome/ADU/DADU are now ‘condos’. There is not a consistent way to parse out those homes yet to give a complete picture of the condo market. But, a quick look shows that there were 248 closed West Seattle condo transactions in 2024. 81 of them were considered New Construction. There were only a handful of traditional condo projects in West Seattle in 2024, so likely 1/3 of these closings were of the Home/ADU/DADU type. If you don’t account for the new construction, the West Seattle median price (previously owned) would be at 565k. Seattle Metro median for previously owned is 499k. These condo’s, or backyard cottages, are the ‘Middle Housing’ that the city of Seattle is hoping to bring more density and affordability.

What will 2025 look like?

Likely more of the same. 2025 pricing is expected to climb and see between 4-5% appreciation. A far cry from the 15-20% annual rise from the covid years, but still relatively high. This is a result largely from continued higher interest rates. Rates should remain around 6-7% which have caused a lock-in effect for current homeowners. Even with higher pricing and higher interest rates, people need a place to live. Seattle’s new growth policy is due this year and will have huge implications for what the future will look like for city density and affordability. Listen here to KUOW’s interesting discussion on Seattle’s Growth policy on 1/10/25.